Exploring the intricacies of Costco Car Insurance Coverage for Saudi Arabia Residents, this piece delves into the benefits, types of coverage, cost factors, and more, offering a comprehensive guide for those seeking car insurance in the region.

Providing insights into the customization process, customer support, and claims procedures, this discussion aims to equip readers with essential knowledge to make informed decisions regarding their car insurance needs.

Introduction to Costco Car Insurance Coverage in Saudi Arabia

Costco offers car insurance coverage for residents in Saudi Arabia, providing a range of benefits and services tailored to meet the needs of drivers in the region.

Benefits of Choosing Costco for Car Insurance in Saudi Arabia

- Competitive premiums that offer value for money.

- 24/7 customer support for assistance and claims processing.

- Wide network of partner garages for repairs and maintenance.

- Additional perks such as roadside assistance and coverage for personal belongings.

Availability and Eligibility Criteria for Costco Car Insurance in Saudi Arabia

Costco car insurance is available to Saudi Arabia residents who meet certain criteria, including:

- Holding a valid driver's license issued in Saudi Arabia.

- Owning a registered vehicle in the country.

- Complying with the required documentation and information needed for policy issuance.

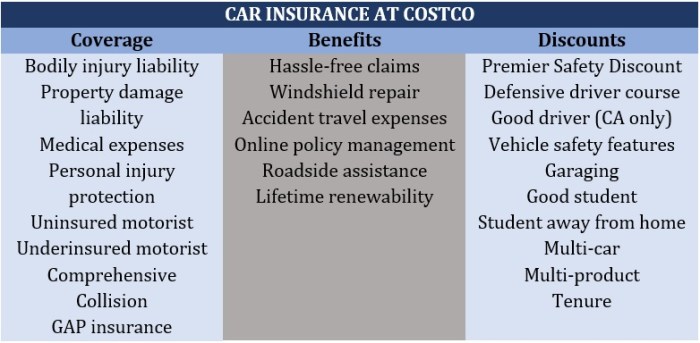

Types of Coverage Offered by Costco for Car Insurance

When it comes to car insurance coverage options, Costco in Saudi Arabia provides a range of choices to suit the needs of different drivers. Let's explore the different types of coverage offered by Costco and how they compare to other insurance providers in the country.

Comprehensive Coverage

- Costco offers comprehensive coverage, which includes protection against damages to your vehicle due to accidents, theft, vandalism, and natural disasters.

- This type of coverage is ideal for drivers looking for extensive protection for their vehicle.

Third-Party Liability Coverage

- Costco also provides third-party liability coverage, which covers the costs associated with damage to another person's vehicle or property in an accident where you are at fault.

- This coverage is mandatory in Saudi Arabia and helps protect you from potential financial liabilities.

Personal Accident Coverage

- Additionally, Costco offers personal accident coverage, which provides financial protection in the event of injuries or death resulting from a car accident.

- This coverage can help cover medical expenses, loss of income, and other related costs.

Customizable Coverage Options

- One of the key advantages of choosing Costco for car insurance in Saudi Arabia is the ability to customize your coverage to suit your individual needs.

- Drivers can opt for additional coverage options such as roadside assistance, rental car reimbursement, and windshield repair.

- By tailoring your coverage, you can ensure that you have the protection you need without paying for unnecessary extras.

Cost Factors and Premium Calculation for Costco Car Insurance

When it comes to car insurance premiums in Saudi Arabia, Costco follows a specific calculation method based on various factors. Understanding how these premiums are calculated can help residents make informed decisions about their coverage.

Factors Influencing Car Insurance Premiums

- The type of coverage chosen: The extent of coverage you opt for, whether it's comprehensive, third-party, or a combination of both, will directly impact your premium.

- Vehicle details: Factors such as the make and model of your car, its age, engine size, and value will affect the premium amount.

- Driver's profile: Your age, driving experience, claims history, and whether you have any previous driving violations will also play a role in determining your premium.

- Usage of the vehicle: How often you drive, the purpose of use (personal or commercial), and the typical driving distance all contribute to the premium calculation.

- Location: The area where you live or primarily operate your vehicle can influence the premium due to factors like traffic density, crime rates, and accident statistics.

Costco uses a combination of these factors to determine the risk associated with insuring your vehicle, which ultimately affects the premium you pay.

Tips to Lower Car Insurance Premiums

- Opt for a higher deductible: Choosing a higher deductible means you'll pay more out of pocket in case of a claim, but it can lead to lower premiums.

- Drive safely: Maintaining a clean driving record by avoiding accidents and traffic violations can help lower your risk profile and, subsequently, your premium.

- Bundle policies: If you have multiple insurance needs, consider bundling them with Costco to potentially qualify for discounts on your premiums.

- Install security features: Equipping your vehicle with anti-theft devices or safety features can reduce the risk of theft or accidents, which may result in lower premiums.

- Review and update your coverage: Regularly assess your insurance needs and coverage to ensure you're not over-insured, which can lead to unnecessary premium costs.

Claims Process and Customer Support for Costco Car Insurance

When it comes to filing car insurance claims with Costco in Saudi Arabia, policyholders can expect a straightforward and efficient process. Costco aims to provide prompt assistance to ensure a hassle-free experience for its customers.

Claims Filing Procedure

- Notify Costco immediately after an accident or damage to your vehicle occurs.

- Submit the necessary documents, including the police report, photos of the incident, and any other relevant information requested by Costco.

- Cooperate with the appointed adjuster for the evaluation of the damage and the claim settlement process.

- Follow up with Costco for updates on the status of your claim and provide any additional information if required.

Customer Support Services

Costco offers comprehensive customer support services to assist policyholders throughout their car insurance journey in Saudi Arabia. From policy inquiries to claims assistance, Costco is committed to providing timely and reliable support to its customers.

Successful Claim Resolutions and Customer Experiences

"I was involved in a minor accident, and I was impressed by how quickly Costco processed my claim. The customer support team guided me through the entire process, and I received my settlement without any delays."

Sarah, Costco Car Insurance Policyholder

"I had to file a claim for a major repair on my vehicle, and Costco handled the entire process professionally. They communicated effectively and ensured that my claim was resolved to my satisfaction."

Ahmed, Costco Car Insurance Policyholder

Closing Summary

In conclusion, Costco Car Insurance Coverage for Saudi Arabia Residents emerges as a reliable option with its tailored coverage, competitive pricing, and efficient claims process. By choosing Costco, residents can secure their vehicles with confidence and peace of mind.

Common Queries

Is Costco car insurance available to all residents in Saudi Arabia?

Costco car insurance is typically available to Saudi Arabia residents, but eligibility criteria may vary. It's best to contact Costco directly for specific information.

What are the common factors that influence the cost of car insurance at Costco in Saudi Arabia?

Factors like the driver's age, driving history, type of vehicle, and coverage options chosen can impact the cost of car insurance at Costco.

How can Saudi Arabia residents lower their car insurance premiums with Costco?

Residents can potentially lower their premiums by maintaining a clean driving record, opting for higher deductibles, bundling policies, and taking advantage of discounts offered by Costco.