Delve into the world of car insurance quotes and uncover the power of leveraging your date of birth and driving history for discounts. As we explore this topic, you'll discover valuable insights that can potentially save you money while ensuring optimal coverage.

Explore the impact of age on insurance rates and learn how your driving record plays a crucial role in determining the cost of your premiums.

Importance of Date of Birth in Car Insurance Quotes

Date of birth plays a significant role in determining car insurance premiums. Insurance companies utilize this information to assess risk and calculate rates accordingly.

Impact of Age on Car Insurance Rates

- Younger Drivers: Insurance companies often consider younger drivers to be riskier due to less driving experience and higher likelihood of accidents. As a result, younger drivers typically face higher insurance premiums.

- Older Drivers: On the other hand, older drivers may also face increased rates as they are perceived to have slower reflexes and potential health issues that could impact their driving abilities.

Utilizing Driving History for Lower Insurance Costs

When it comes to getting the best car insurance rates, your driving history plays a significant role. Insurance companies use your driving record to assess the level of risk you pose as a driver. A clean driving record typically translates to lower insurance premiums, while a history of accidents or violations can lead to higher rates.

Impact of a Clean Driving Record

Maintaining a clean driving record, free of accidents or traffic violations, is one of the most effective ways to secure lower insurance costs. Insurance companies view drivers with a clean record as less risky, and therefore, are more likely to offer them lower premiums.

For example, a driver with no accidents or tickets in the past five years may qualify for a safe driver discount, resulting in significant savings on their insurance policy.

Effect of Accidents and Violations on Premiums

On the other hand, drivers with a history of accidents, speeding tickets, DUIs, or other violations are considered higher risk by insurance companies. As a result, they are likely to face higher insurance premiums. For instance, a driver with multiple speeding tickets or a DUI conviction may see their insurance rates increase substantially due to the increased risk they present to the insurer.

Examples of Violations Impacting Rates

- Speeding Tickets: A single speeding ticket can cause insurance rates to go up by a certain percentage. Multiple speeding tickets can result in even higher premiums.

- Accidents: Being involved in at-fault accidents can significantly raise insurance rates, especially if there is a history of multiple accidents.

- DUI/DWI Convictions: Driving under the influence violations can lead to a substantial increase in insurance premiums due to the increased risk of accidents associated with impaired driving.

Strategies to Leverage Date of Birth and Driving History

When it comes to getting the best car insurance rates, your date of birth and driving history can play a significant role. By understanding how to leverage these factors to your advantage, you can potentially save money on your insurance premiums.

Using a Favorable Date of Birth

- Younger drivers tend to pay higher insurance premiums due to perceived higher risk. If you have a favorable date of birth, such as being older, you may qualify for lower rates.

- Insurance companies often consider older individuals to be more experienced and responsible drivers, leading to lower premiums.

Improving Your Driving Record

- Safe driving habits can lead to a clean driving record, which can result in lower insurance costs.

- Avoiding traffic violations and accidents demonstrates to insurance providers that you are a low-risk driver, making you eligible for discounts.

- Consider taking defensive driving courses to improve your driving skills and potentially qualify for additional discounts on your insurance.

Bundling Policies and Defensive Driving Courses

- Combining multiple insurance policies, such as auto and home insurance, with the same provider can often lead to discounted rates.

- Defensive driving courses not only enhance your driving skills but also show insurance companies that you are proactive about safety, potentially lowering your premiums.

- Insurance companies value policyholders who take steps to reduce risk, and bundling policies or completing defensive driving courses can be seen as positive actions.

Understanding the Relationship Between Age, Driving History, and Discounts

Age and driving history play a crucial role in determining car insurance premiums. Let's delve deeper into how these factors are interconnected and can lead to discounts for policyholders.

Age Groups and Insurance Categorization

Age groups are typically categorized into brackets such as under 25, 25-40, 41-65, and over 65 for insurance purposes. Younger drivers under 25 are considered high-risk due to lack of experience, while older drivers over 65 may also face higher premiums due to potential health issues impacting their driving abilities.

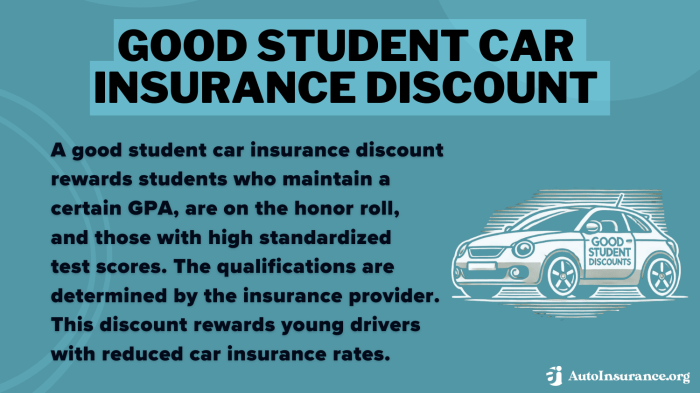

Combination of Age and Driving History for Discounts

A combination of age and driving history can often result in discounts on car insurance premiums. For example, a young driver with a clean driving record may receive lower rates compared to another driver in the same age group with multiple traffic violations.

Similarly, older drivers with a long history of safe driving are likely to qualify for discounts due to their proven track record of responsible behavior on the road.

Impact of Safe Driving History on Premiums

A long history of safe driving can significantly impact insurance premiums by demonstrating to insurers that the policyholder is a low-risk driver. Insurance companies often reward safe drivers with lower rates, as they are less likely to file claims or be involved in accidents.

This highlights the importance of maintaining a clean driving record over the years to benefit from reduced insurance costs.

Closing Summary

In conclusion, understanding how insurance companies factor in your date of birth and driving history can empower you to make informed decisions when seeking car insurance quotes. By utilizing this knowledge to your advantage, you can secure the best possible rates tailored to your unique circumstances.

FAQs

How can I use my date of birth to lower insurance costs?

You can potentially lower your insurance costs by being aware of how your age impacts premiums and strategically selecting the most advantageous date of birth during the quoting process.

Does a clean driving record always lead to lower insurance rates?

While a clean driving record is generally favorable, insurance companies consider various factors when determining rates. However, maintaining a clean record can often result in more affordable premiums.

Can defensive driving courses help reduce insurance costs?

Yes, completing defensive driving courses can demonstrate your commitment to safe driving practices, potentially leading to discounts from insurance providers.