Delving into the realm of Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing?, the discussion unfolds with a unique perspective, enticing readers with a narrative that promises both intrigue and insight.

Providing a detailed overview of the topic that captures the essence of current trends and developments in the automotive insurance landscape of Saudi Arabia.

Overview of Automotive Insurance in Saudi Arabia

In Saudi Arabia, automotive insurance plays a crucial role in protecting vehicle owners from financial losses in case of accidents or damages. It is mandatory for all vehicle owners to have insurance coverage, as per the regulations set by the Saudi Arabian Monetary Authority (SAMA).

Current Landscape of Automotive Insurance

The automotive insurance market in Saudi Arabia is highly competitive, with several insurance companies offering a wide range of coverage options to vehicle owners. These companies provide various types of insurance plans, including comprehensive, third-party liability, and personal accident coverage.

Key Players in the Automotive Insurance Industry

Some of the prominent insurance companies operating in the automotive insurance sector in Saudi Arabia include Tawuniya, Medgulf, AXA, Walaa Insurance, and BUPA Arabia. These companies have a strong presence in the market and offer competitive insurance packages to cater to the diverse needs of vehicle owners.

Importance of Automotive Insurance for Vehicle Owners

Automotive insurance is essential for vehicle owners in Saudi Arabia to protect themselves from potential financial liabilities in case of accidents, theft, or damage to their vehicles. Having insurance coverage provides peace of mind and ensures that vehicle owners are financially protected in unforeseen circumstances.

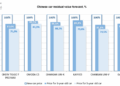

Factors Influencing Automotive Insurance Quotes

When it comes to determining automotive insurance quotes in Saudi Arabia, several key factors come into play. These factors can greatly impact the premiums individuals pay for their coverage.

Vehicle Type and Age

The type and age of the vehicle being insured play a significant role in determining insurance quotes. Newer, more expensive cars typically have higher premiums due to the increased cost of repairs or replacement. Additionally, high-performance vehicles may also lead to higher premiums as they are more likely to be involved in accidents.

Driving History and Behavior

- Having a clean driving record with no accidents or traffic violations can result in lower insurance premiums. On the other hand, individuals with a history of accidents or speeding tickets may face higher rates.

- Behavior on the road, such as driving under the influence or reckless driving, can also impact insurance quotes. Insurance companies view risky behavior as an increased liability and adjust premiums accordingly.

- Annual mileage is another factor that insurers consider. Vehicles that are driven more frequently are at a higher risk of accidents, leading to higher premiums.

Technology and Innovation in Automotive Insurance

Technology plays a significant role in shaping the trends of automotive insurance, especially in a rapidly evolving market like Saudi Arabia. With advancements in telematics, IoT devices, AI, and machine learning, the landscape of automotive insurance is undergoing a transformation.

Telematics and IoT Devices

Telematics and IoT devices are revolutionizing the way insurance companies calculate quotes by providing real-time data on driving behavior. These devices monitor aspects such as speed, braking patterns, and distance traveled, allowing insurers to offer more personalized and accurate premiums based on individual driving habits.

- Telematics devices track driving behavior to assess risk levels accurately.

- IoT devices provide insurers with valuable data to tailor insurance policies to individual drivers.

- Insurers can incentivize safe driving practices through usage-based insurance models.

AI and Machine Learning

The integration of AI and machine learning algorithms in automotive insurance processes has the potential to streamline operations, enhance customer experience, and optimize risk assessment. These technologies can analyze vast amounts of data to predict claim likelihood, detect fraud, and improve pricing strategies.

- AI algorithms can automate claims processing, leading to faster settlements.

- Machine learning models can identify patterns in data to predict future trends and risks.

- Insurers can offer more customized products and services based on AI-driven insights.

Regulatory Environment and its Influence

The regulatory framework governing automotive insurance in Saudi Arabia plays a crucial role in shaping the industry and influencing insurance premiums. Recent regulatory changes have had a significant impact on how insurance companies operate and how quotes are determined.

Regulatory Framework in Saudi Arabia

In Saudi Arabia, the regulatory environment for automotive insurance is overseen by the Saudi Arabian Monetary Authority (SAMA). SAMA sets the guidelines and regulations that insurance companies must adhere to, ensuring fair practices and consumer protection. These regulations cover aspects such as pricing, coverage requirements, and claims processing.

- Insurance companies are required to obtain approval from SAMA for their pricing structures, ensuring that premiums are reasonable and in line with industry standards.

- Minimum coverage requirements for automotive insurance are set by SAMA to protect both drivers and third parties in the event of accidents or damages.

- Claims processing procedures are also regulated to ensure timely and fair resolution of claims, benefiting both policyholders and insurance companies.

Recent Regulatory Changes

Recent regulatory changes in Saudi Arabia have focused on enhancing consumer protection, promoting transparency, and improving the overall efficiency of the insurance industry. These changes have had a direct impact on insurance premiums and quote trends.

- Introduction of mandatory electronic issuance of insurance policies has streamlined the process and reduced administrative costs, potentially leading to lower premiums for policyholders.

- Implementation of stricter guidelines for claims assessment and settlement has improved the accuracy of premium calculations, ensuring that policyholders are charged fairly based on risk factors.

- Regulatory efforts to combat insurance fraud and abuse have helped stabilize premiums by reducing fraudulent claims and improving the overall risk assessment process.

Government Policies and Impact on Insurance Industry

Government policies in Saudi Arabia play a crucial role in shaping the insurance industry and influencing insurance quote trends. By setting clear guidelines and regulations, the government can create a stable and competitive market environment that benefits both insurance companies and consumers.

- Government initiatives to promote digital innovation and technology adoption in the insurance sector have led to more efficient processes and reduced operational costs, potentially resulting in lower premiums for policyholders.

- Regulatory support for initiatives that promote road safety and reduce accidents can lead to lower claims costs for insurance companies, which may translate into more competitive premiums for policyholders.

- Government efforts to increase insurance awareness and financial literacy among consumers can help improve the understanding of insurance products and coverage options, enabling consumers to make more informed decisions when purchasing insurance.

Consumer Behavior and Preferences

Consumer behavior plays a significant role in shaping automotive insurance trends in Saudi Arabia. Understanding the preferences of Saudi Arabian consumers when it comes to choosing insurance policies is crucial for insurance providers to tailor their offerings effectively. Additionally, customer feedback and reviews have become increasingly influential in the insurance industry, impacting the development and refinement of insurance products and services.

Common Preferences of Saudi Arabian Consumers

When it comes to selecting insurance policies, Saudi Arabian consumers often prioritize certain factors. These may include:

- Comprehensive coverage options to ensure protection in various scenarios

- Affordable premiums that match their budget constraints

- Efficient and responsive customer service for quick assistance and support

- Transparent and easy-to-understand policy terms and conditions

- Additional benefits or discounts for loyal customers

Role of Customer Feedback and Reviews

Customer feedback and reviews hold significant influence in the insurance sector in Saudi Arabia. They provide valuable insights into the experiences of policyholders, helping insurance companies identify areas for improvement and innovation. Positive reviews can enhance the reputation of an insurance provider, attracting more customers, while negative feedback can prompt necessary adjustments to policies and services.

Ultimate Conclusion

Concluding the dialogue with a concise summary that encapsulates the key points discussed, leaving readers with a lasting impression of the evolving dynamics within the automotive insurance sector in Saudi Arabia.

Frequently Asked Questions

What are the factors influencing changes in automotive insurance quotes?

Various factors such as vehicle type, age, driving history, and behavior play a significant role in determining fluctuations in insurance quotes.

How does consumer behavior impact automotive insurance trends in Saudi Arabia?

Consumer behavior influences insurance trends by shaping preferences and choices of insurance policies among Saudi Arabian consumers.

What role does technology play in shaping automotive insurance trends in Saudi Arabia?

Technology, including telematics, IoT devices, and potential AI integration, is revolutionizing insurance quotes and the overall industry landscape.