Embarking on the journey of understanding Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, readers are invited into a world of valuable insights and practical advice that can make a significant difference in navigating the realm of car insurance for high-risk drivers.

The subsequent section will delve into the nuances of what discount car insurance quotes entail and how they can benefit those facing high-risk driver classifications.

Introduction to High-Risk Drivers

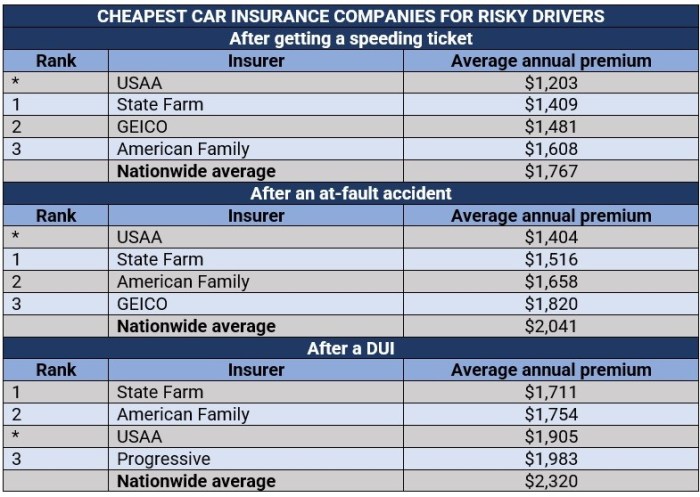

High-risk drivers are individuals who are considered more likely to be involved in accidents or file insurance claims, leading to higher costs for insurance providers. Factors such as a history of traffic violations, at-fault accidents, poor credit score, or driving a high-performance vehicle can contribute to being classified as a high-risk driver.

Factors Contributing to High-Risk Classification

- Previous Traffic Violations: Accumulating tickets or citations for speeding, reckless driving, or DUIs can signal risky behavior on the road.

- At-Fault Accidents: Being responsible for accidents in the past can indicate a higher likelihood of future incidents.

- Poor Credit Score: Insurance companies may view individuals with poor credit as less financially responsible, linking it to a higher risk of insurance claims.

- Driving High-Performance Vehicles: Cars with powerful engines or high speeds are often associated with increased risks, leading to higher insurance premiums.

Challenges Faced by High-Risk Drivers

- Higher Premiums: Insurance companies charge higher rates to offset the increased risk associated with high-risk drivers.

- Limited Options: Some insurance providers may be hesitant to offer coverage to high-risk drivers, limiting their choices in the market.

- SR-22 Requirements: In some cases, high-risk drivers may need to file an SR-22 form with the state to prove financial responsibility, adding an extra layer of complexity to obtaining insurance.

Understanding Discount Car Insurance Quotes

Discount car insurance quotes refer to offers provided by insurance companies that allow high-risk drivers to obtain coverage at a reduced rate. These quotes are specifically tailored to individuals who may have a history of accidents, violations, or other factors that make them a higher risk to insure.

How Discount Car Insurance Quotes Differ

Discount car insurance quotes differ from standard quotes in that they take into account the unique circumstances of high-risk drivers. Insurers may offer discounts or special rates to these individuals in order to make coverage more affordable. These quotes often come with specific conditions or requirements that must be met in order to qualify for the discounted rate.

- Discounts for completing defensive driving courses

- Specialized coverage options for high-risk drivers

- Flexible payment plans to accommodate budget constraints

Benefits of Seeking Discount Car Insurance Quotes

Seeking discount car insurance quotes can provide several benefits for high-risk drivers. By exploring these options, individuals may be able to find coverage that is both affordable and comprehensive, despite their past driving history.

- Cost-effective coverage options tailored to high-risk drivers

- Potential savings on premiums compared to standard rates

- Access to specialized insurers who understand the needs of high-risk drivers

Tips for High-Risk Drivers to Obtain Discount Car Insurance Quotes

As a high-risk driver in Canada, it can be challenging to find affordable car insurance. However, there are strategies you can use to improve your driving record and qualify for discounts from insurance companies. It's important to compare multiple quotes to ensure you're getting the best deal possible.

Insurance Companies Offering Discounts to High-Risk Drivers

- Intact Insurance: Intact offers discounts to high-risk drivers who complete defensive driving courses or install telematics devices in their vehicles.

- Belairdirect: Belairdirect provides discounts to high-risk drivers who maintain a clean driving record for a certain period of time.

- Desjardins Insurance: Desjardins offers discounts to high-risk drivers who bundle their car insurance with other policies.

Strategies to Improve Your Driving Record

- Practice safe driving habits: Avoid speeding, reckless driving, and distractions while behind the wheel.

- Take a defensive driving course: Completing a defensive driving course can improve your driving skills and demonstrate to insurance companies that you are committed to safe driving.

- Consider a telematics device: Installing a telematics device in your vehicle can track your driving habits and potentially lead to lower insurance premiums if you prove to be a safe driver.

Importance of Comparing Multiple Quotes

When you're a high-risk driver, it's crucial to compare quotes from different insurance companies to find the best deal. Each company has its own criteria for determining insurance rates, so by comparing multiple quotes, you can ensure you're getting the most competitive price for your coverage.

Factors Influencing Car Insurance Premiums for High-Risk Drivers

When it comes to high-risk drivers, several factors come into play that impact their car insurance premiums. These factors are crucial to understand as they can significantly affect the cost of insurance for drivers in this category.

Driving Record

- A history of accidents, traffic violations, or DUI convictions can greatly increase insurance premiums for high-risk drivers.

- High-risk drivers tend to have a higher number of claims filed, leading to higher premiums.

Age and Experience

- Youthful drivers or those with limited driving experience are often considered high-risk and face higher insurance premiums.

- Older drivers with a long history of safe driving may see lower premiums compared to younger high-risk drivers.

Vehicle Type

- The make and model of the vehicle can impact insurance premiums for high-risk drivers.

- High-performance or luxury cars typically cost more to insure for high-risk drivers due to the increased risk of accidents.

Location

- High-risk drivers living in areas with high crime rates or high traffic congestion may face higher insurance premiums.

- Urban areas tend to have higher insurance rates for high-risk drivers compared to rural areas.

Insurance History

- Drivers with a history of lapses in coverage or frequent policy cancellations may be considered high-risk and face higher premiums.

- Maintaining continuous insurance coverage and a good payment history can help reduce premiums for high-risk drivers.

Summary

As we draw to a close on the discussion surrounding Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, it becomes evident that with the right strategies and knowledge, high-risk drivers can indeed find the insurance coverage they need at a more affordable rate.

Helpful Answers

What are some common factors contributing to high-risk driver classification?

Factors such as age, driving history, vehicle type, and location can play a significant role in labeling drivers as high-risk.

How can high-risk drivers improve their chances of qualifying for insurance discounts?

By maintaining a clean driving record, taking defensive driving courses, and comparing quotes from multiple insurance companies, high-risk drivers can increase their chances of obtaining discounts.

Do all insurance companies in Canada offer discounts to high-risk drivers?

Not all insurance companies provide discounts to high-risk drivers, so it's essential to research and compare offerings to find the best deal.

What are some key differences between discount car insurance quotes and standard quotes?

Discount car insurance quotes often offer reduced rates specifically tailored for high-risk drivers, whereas standard quotes may not account for the unique circumstances of high-risk individuals.

Is comparing multiple quotes really necessary for high-risk drivers seeking insurance discounts?

Yes, comparing quotes from different insurance providers is crucial for high-risk drivers as it allows them to find the most competitive rates and suitable coverage options.