Kicking off with Shop Car Insurance Quotes on a Budget: Australia Edition, this opening paragraph is designed to captivate and engage the readers, providing a clear overview of the topic at hand.

Detailing the key components and factors influencing car insurance quotes in Australia, this introductory paragraph sets the stage for an informative discussion ahead.

Understanding Car Insurance Quotes

When looking for car insurance quotes in Australia, it's essential to understand the factors that can influence the cost. Insurance companies consider various aspects when calculating premiums, so knowing these key components can help you make an informed decision.

Factors that Influence Car Insurance Quotes in Australia

- Your age and driving experience

- The make and model of your car

- Your location and where the car is parked

- Your driving record and claims history

- The level of coverage you choose

Key Components Included in a Car Insurance Quote

- Third-party liability coverage

- Comprehensive coverage

- Collision coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection

How Insurance Companies Calculate Premiums Based on Different Variables

Insurance companies use a combination of the factors mentioned above to determine your premium. They assess the risk associated with insuring you based on your personal details, driving history, and the type of car you drive. The higher the risk, the higher the premium you are likely to pay.

Additionally, factors like the level of coverage and any additional features you choose can also impact the final cost of your car insurance.

Budget-Friendly Insurance Options

Finding budget-friendly car insurance quotes in Australia can be a challenging task, but with the right approach, you can secure adequate coverage without breaking the bank. By understanding the types of coverage that are essential for cost-effective insurance and comparing different insurance providers, you can find the most economical option that suits your needs and budget.

Types of Coverage for Cost-Effective Insurance

When looking for budget-friendly car insurance quotes in Australia, it's important to consider the types of coverage that are essential to protect yourself and your vehicle while keeping costs down. Here are some key types of coverage to prioritize:

- Third-Party Property Damage: This is the most basic form of car insurance required by law in Australia. It covers damage to other people's property caused by your vehicle.

- Comprehensive Insurance: While comprehensive insurance may seem more expensive upfront, it can actually be more cost-effective in the long run as it provides coverage for a wide range of events, including theft, vandalism, and natural disasters.

- Excess: Choosing a higher excess amount can lower your premium, making your car insurance more budget-friendly. Just make sure you can afford the excess in case you need to make a claim.

- No-Claim Bonus: Many insurance providers offer a no-claim bonus, which rewards policyholders for not making a claim by reducing their premium. This can help you save money on your car insurance over time.

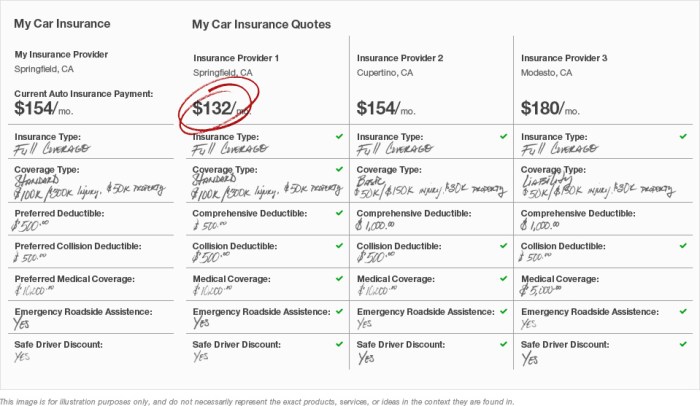

Comparing Insurance Providers for Economical Options

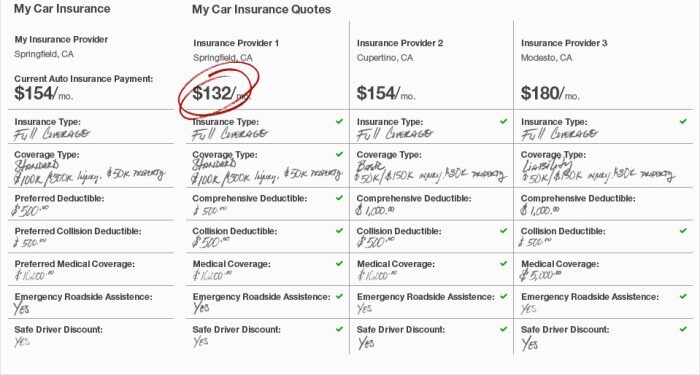

To find the most budget-friendly car insurance quotes in Australia, it's essential to compare different insurance providers and their offerings. Consider factors such as premiums, coverage options, customer reviews, and claim processes to determine which provider offers the best value for your money.

Don't forget to check for any discounts or promotions that could further reduce your insurance costs.

Comparison Tools and Websites

When shopping for car insurance quotes on a budget in Australia, utilizing comparison tools and websites can help you find the best deals. These platforms allow you to easily compare different insurance policies from various providers, helping you make an informed decision that suits your needs and budget.

Popular Comparison Websites in Australia

- 1. Compare the Market: This website allows you to compare car insurance quotes from multiple providers in Australia.

- 2. Finder: Finder is a popular comparison platform that offers a wide range of insurance options, including car insurance.

- 3. Canstar: Canstar provides comprehensive comparisons of car insurance policies, helping you find affordable options.

How to Effectively Use Comparison Tools

- Utilize filters: Use filters on comparison websites to customize your search based on factors like coverage type, price range, and additional features.

- Compare policies side by side: Compare the details of each policy, including coverage limits, excess amounts, and additional benefits, to ensure you're getting the best value for your money.

- Read reviews: Take the time to read reviews from other customers to gauge the customer service and satisfaction levels of each insurance provider.

Importance of Comparing Policies Beyond Price

- Coverage options: Look beyond the price and consider the coverage options provided by each policy. Ensure that the policy meets your specific needs and offers adequate protection.

- Excess amounts: Compare the excess amounts for each policy, as a lower excess may result in higher premiums but could save you money in the event of a claim.

- Additional benefits: Consider the additional benefits offered by each policy, such as roadside assistance, rental car coverage, and no-claim bonuses, to determine the overall value of the policy.

Discounts and Savings

When it comes to car insurance in Australia, maximizing discounts and savings is crucial for keeping costs down. Many insurance companies offer various discounts that policyholders can take advantage of to reduce their premiums. Let's explore some common discounts and strategies for saving money on car insurance.

Common Discounts Offered by Car Insurance Companies

- Multi-policy discount: This discount is available when you bundle multiple insurance policies, such as car and home insurance, with the same provider.

- No-claim bonus: Insurers reward policyholders who have not made any claims during a certain period with a discount on their premiums.

- Low mileage discount: If you don't drive your car often, you may qualify for a low mileage discount.

- Safe driver discount: Maintaining a clean driving record without any accidents or traffic violations can lead to savings on your car insurance.

- Age-based discounts: Some insurers offer discounts based on the age of the policyholder, such as discounts for drivers over a certain age or discounts for young drivers who have completed a safe driving course.

Strategies for Maximizing Savings on Car Insurance Premiums

- Compare quotes: Always shop around and compare quotes from multiple insurers to ensure you're getting the best deal.

- Adjust coverage levels: Consider adjusting your coverage levels based on your needs to avoid paying for unnecessary coverage.

- Pay annually: Some insurers offer discounts if you pay your premium annually instead of monthly.

- Increase your excess: Opting for a higher excess amount can lower your premiums, but make sure you can afford the excess if you need to make a claim.

Bundling Policies for Significant Cost Reductions

- Bundling multiple policies, such as car, home, and contents insurance, with the same insurer can lead to significant cost savings.

- Insurers often offer discounts for bundling policies, making it a cost-effective option for those looking to save on insurance premiums.

- By bundling your policies, you may also streamline your insurance management and have a single point of contact for all your insurance needs.

Last Word

Wrapping up our exploration of Shop Car Insurance Quotes on a Budget: Australia Edition, we have delved into various aspects of finding affordable car insurance, offering insights and tips for readers to consider.

Essential FAQs

What factors influence car insurance quotes in Australia?

Car make and model, driver's age and driving record, location, and coverage level are key factors that impact car insurance quotes in Australia.

How can I maximize savings on car insurance premiums?

You can maximize savings by bundling policies, maintaining a good driving record, opting for a higher deductible, and exploring available discounts from insurance companies.

Which types of coverage are essential for cost-effective insurance in Australia?

Comprehensive and third-party property damage coverage are essential for cost-effective insurance in Australia, providing a balance between protection and affordability.